Industry-news

Analysis of China's Lighting Industry Export Situation in the First Three Quarters of 2025

1.Siutuation

In the first three quarters of 2025, China's total exports of lighting products reached US$38 billion, a year-on-year decrease of 7.8%, with the decline widening by 0.7 percentage points compared to the first eight months, and the growth rate in the same period last year was -5.0%. Among them, the export value of LED lighting products was US$29.7 billion, a year-on-year decrease of 3.4%, while the growth rate in the same period last year was -5.1%, accounting for 78.1% of the total export value, an increase of 3.5 percentage points compared to the same period last year.

The monthly export value in September 2025 was 3.6 billion US dollars, the lowest value since March 2024 for 17 consecutive months, a year-on-year decline of 13.5%, and a slight decrease from the previous value of -14.8%; On a month on month basis, it decreased by 9.3%, compared to the previous value of -10.8%. Among them, LED lighting products amounted to 2.8 billion US dollars, a year-on-year decrease of 13.3%.

Regarding exports to the US, in September 2025, lighting product exports to the US totaled $730 million, a year-on-year decrease of 30.3%, with the decline slightly widening to become the second lowest after May (-36.6%). Month-on-month, it also declined slightly by 1.2%, accounting for 20.2% of total exports, the third lowest after April (17.6%) and May (15.5%). The decline in exports to the US differed from the overall market decline by 16.9 percentage points, the third largest after April (25.2%) and May (28.5%). In the first three quarters of 2025, cumulative lighting product exports to the US totaled only $7.58 billion, a year-on-year decrease of 19.0%, marking the first time in history that its share of total exports fell below 20%.

2.Reason

Four main reasons for the continued decline in lighting exports:

- Weak demand:Only Africa recorded growth in the first three quarters, while all other regions experienced a decline, including Europe and Southeast Asia, which saw slight growth in the first half of the year; North America, East Asia, South Asia, Central Asia and Oceania all saw double-digit declines.The performance of various thematic concepts in regional markets was also lackluster, with only the EU showing flat performance.In the leading single markets, more than two-thirds declined.

-

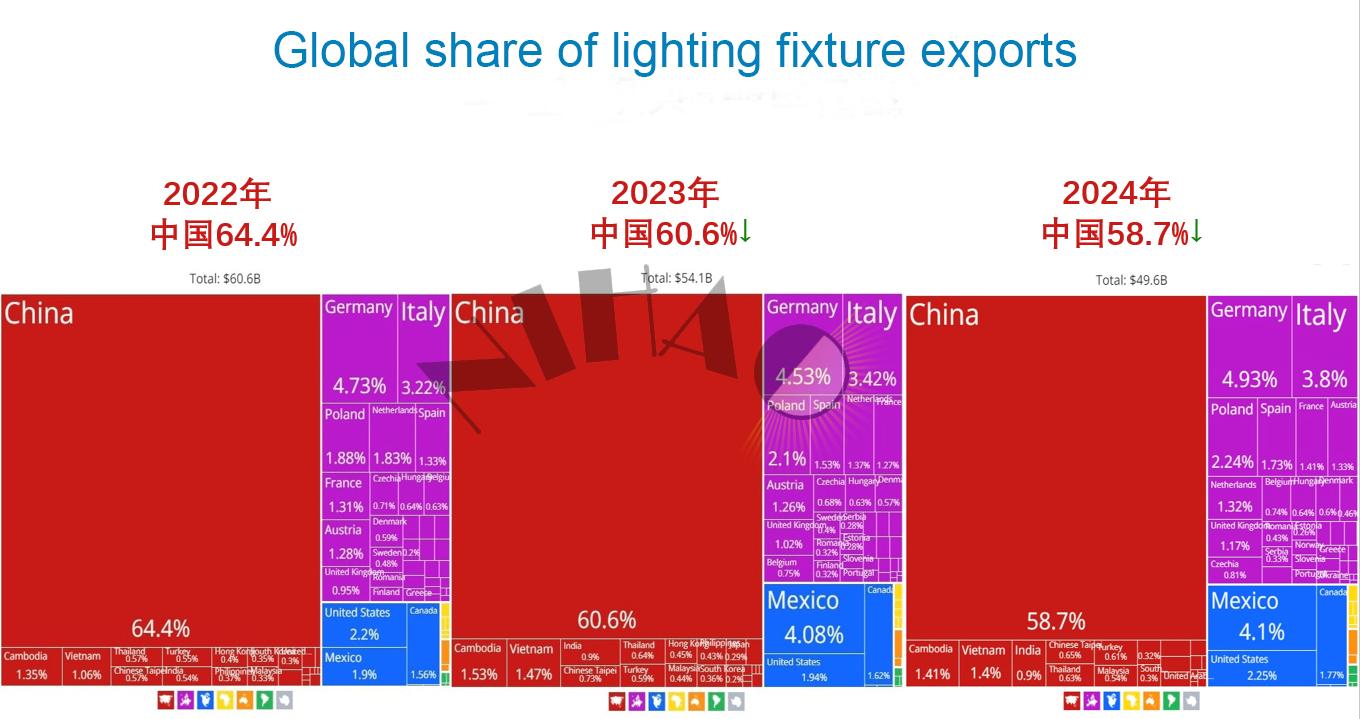

Capacity spillover:Compared to lighting products, China's position as a manufacturing center for LED light sources is relatively stable. The decrease in market share is mainly due to the current trend of large emerging economies pursuing "manufacturing localization" and "localizing production capacity." In 2022,China's LED light source export share 83.8% global market. And 2024 sustain 82.1%. The lighting industry is primarily affected by the spillover of some production capacity and supply chains resulting from the aggressive restructuring of the global industrial chain driven by Europe and the United States, centered on "outsourcing to neighboring countries" and "nearshore production." In short, China's status as a global lighting manufacturing center is facing unprecedented challenges, and in the future, it must further leverage its advantages as a supply chain hub.

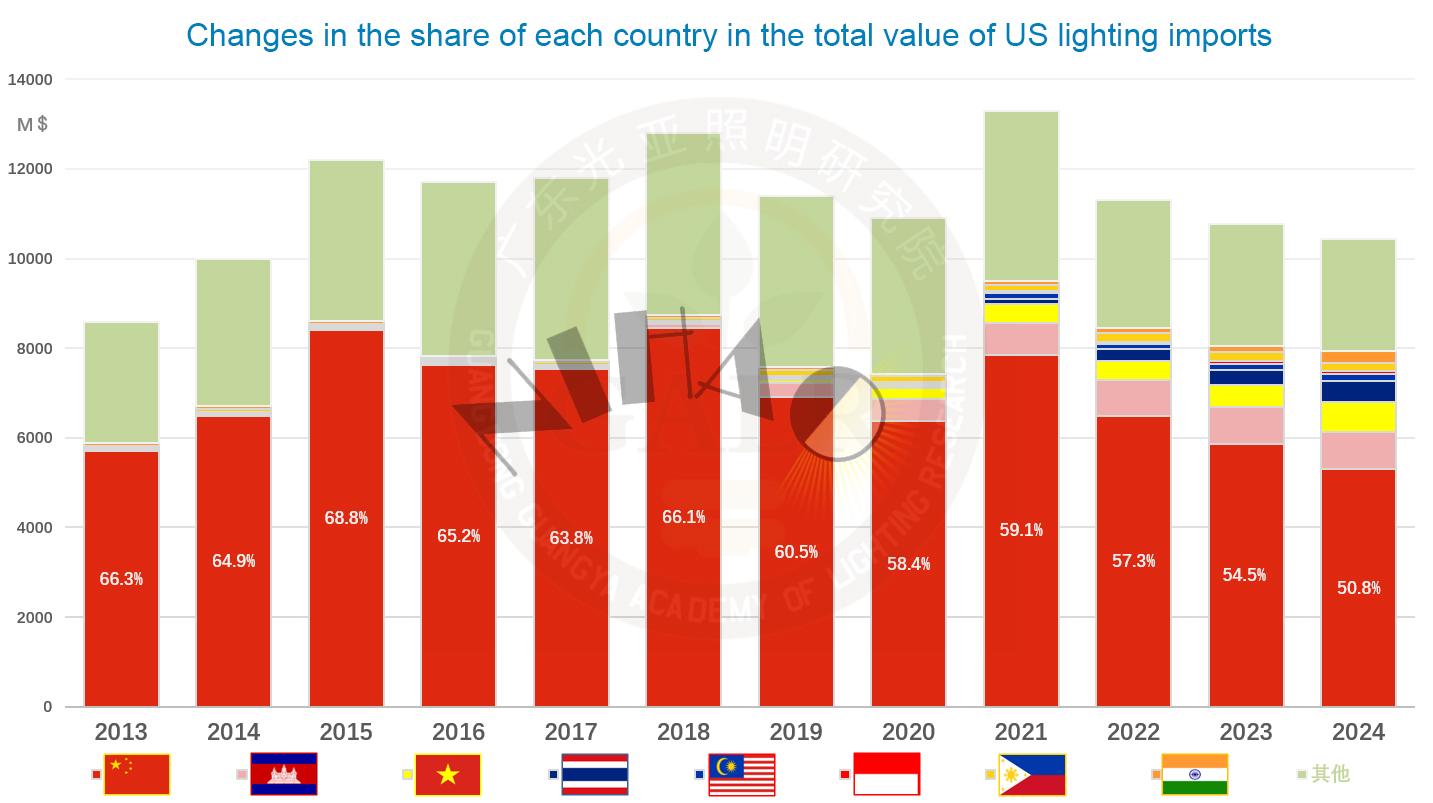

China's share of U.S. lighting imports has fallen from nearly 70% at its peak before 2018 to 50%, while the share from Southeast Asia and India has risen from less than 2% to over 20%.

China's share of U.S. lighting imports has fallen from nearly 70% at its peak before 2018 to 50%, while the share from Southeast Asia and India has risen from less than 2% to over 20%.

-

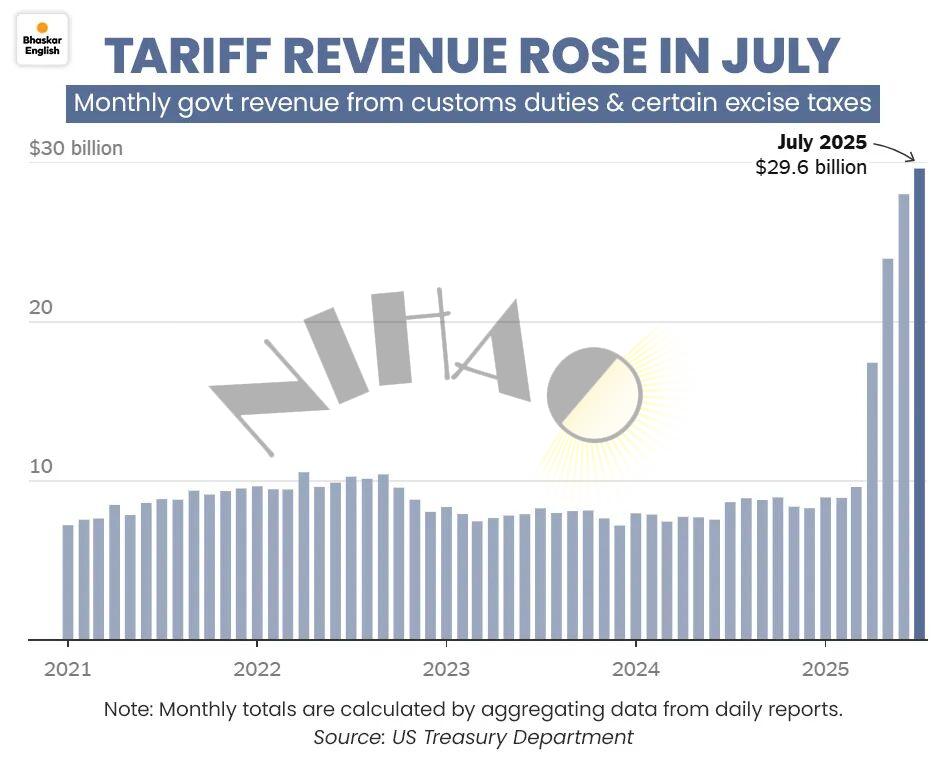

Tariff increases:Since Trump took office for the second time, the US has raised its tariff levels, with the weighted tariff on China being the highest in the world.Compared to other major economies that have shifted production capacity, China's tariffs on lighting products from the US are abnormally high, with LED light sources being at least 110% higher and LED lamps at least 135% higher.As a result, in the first three quarters of 2025, China's exports of lighting products to the United States declined by 19% year-on-year, becoming the biggest drag on the overall market, and its share of the total fell below 20% for the first time in history.Since the implementation of the reciprocal tariffs in April 2025, U.S. tariff revenues have increased significantly.

- Price deflation:In the first three quarters of 2025, the average export price of most products continued to decline. The structural overcapacity on the supply side led more companies to choose to exchange price for volume, which not only prolonged their survival but also intensified the involution of competition.The downward trend in the average export price of LED products is obvious and difficult to reverse. The imbalance between supply and demand is an important factor in price competition. The biggest problem for the industry this year is unprecedented pressure on profits.One consequence of the "rise in the East and fall in the West" in the foreign trade market is that some of the high-value European and American market share has been replaced by low-value emerging markets, affecting the overall value of goods.

3.Outlook

Overall, after a surge in exports in 2021, the overall foreign trade volume of the lighting industry has been declining for three consecutive years, and this downward trend is unlikely to reverse by 2025. The previous situation of sustained growth has fundamentally changed. In terms of technological growth, the industrial dividends brought by LED light source innovation have reached their ceiling, especially in replacement scenarios; market growth has also encountered bottlenecks due to internal competition and external pressures. Currently, the core obstacles are nothing more than the aforementioned weak external demand, fragmented production capacity, increased tariffs, and price deflation. As a result, even if export volume increases, the value is declining, and profits are under unprecedented pressure.Given this general trend, the overall situation of intense competition and external pressure in the lighting foreign trade is unlikely to be reversed in the short term. The "rush to export" and "rush to re-export" caused by the timing of the Spring Festival and the tariff transition period have to some extent exhausted subsequent demand. The additional 100% tariff imposed by the United States on October 10th has only exacerbated the situation, and the contraction of lighting exports for the fourth consecutive year is now a foregone conclusion.Whether it's the risk-reduction restructuring of the global lighting supply chain, driven by major developed economies with "outsourcing to neighboring countries" and "nearshore production" at its core, or the "localization of manufacturing" and "localization of production capacity" being pursued by large emerging economies, China's status as a global lighting manufacturing center is facing unprecedented challenges. China needs to further leverage and strengthen its position as a supply chain hub in the future. At the same time, it should embrace "re-globalization" and firmly adhere to the path of "openness" and "going global."

No previous